Common causes of a bad credit rating include missing payments, loan defaults and even identity theft. If you’ve found yourself on this page, then you may have been rejected for a loan, credit card or mortgage recently. Or perhaps you’re preparing to make a huge financial commitment and want to ensure your credit score doesn’t get in the way of your plans.

Whatever your reasons, here we’ve outlined the seven usual suspects for causing bad credit, plus seven steps you can take to help improve your credit score.

Common causes of bad credit

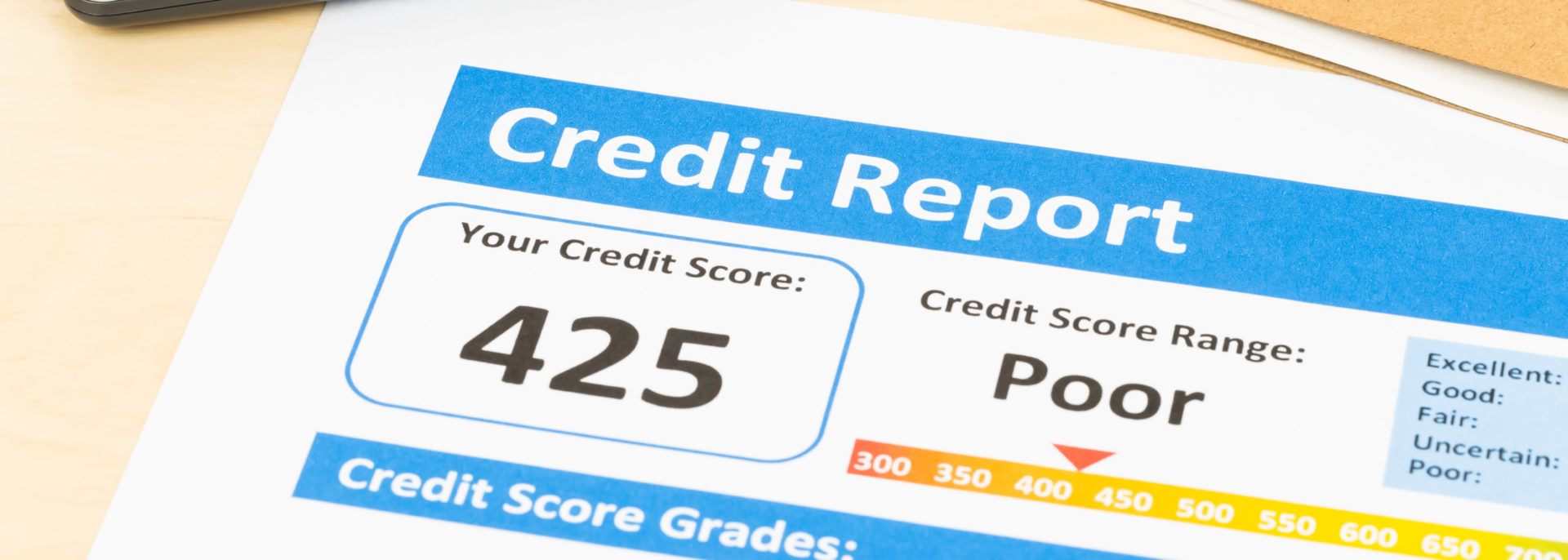

One of the most commonly understood causes of bad credit is a low credit score. However, this score is simply a calculation based on several factors in your financial history, some of which you may find surprising! A bad credit score can be caused by any of the following:

CCJs

A County Court Judgement (CCJ) is when you’re taken to court due to owing money. A CCJ can severely affect your credit score and impact your ability to get credit for upwards of six years.

Defaults

A default on a loan means that you’ve failed to make payments. This therefore negatively affects your chances of securing other credit cards or loans. This is a long-term cause of poor credit as it stays on your file for six years.

Missed payments

Missing payments on your credit cards also have a negative impact on your credit history. Ensure you’re doing everything you can to make payments on time every month.

Bankruptcy

This is a major cause of bad credit as the road to recovery is a long one! Declaring bankruptcy should be the absolute last resort, so ensure you’ve exhausted every other option first.

Payday loans

Payday loans are easy to get but difficult to shake. Taking out a payday loan puts you immediately at risk of bad credit, as they’re notoriously difficult to pay back on time. They also tell potential lenders that you struggle with everyday living costs, meaning your affordability assessment will be affected as well.

Identity theft

Falling victim to fraud is not only upsetting, but it can also have a devastating impact on your future. Poor credit caused by identity theft can be very difficult to rectify. Ensure you keep a close watch on any transactions so you can catch any fraudulent activity right away. You should also periodically check your credit report to make sure there’s no unusual activity in your credit file.

No lending history

Most people are surprised to learn that another major cause of bad credit is having no history of loans or debt. As odd as it sounds, never having a loan or credit card can actually work against you. It means that lenders are unable to judge whether you’ll meet your monthly repayments on time.

How to improve your credit score

Unfortunately, there’s no quick fix for bad credit. Improving a bad credit score will take some time, but will be entirely worth it in the long run. Not only will a healthier credit history improve your chances of being accepted for loans, such as a mortgage, but you could also be eligible for better rates!

Here are some things you could be doing now to help improve your credit score:

Register to vote

Lenders use this to check your name, address and where you’ve lived before – ie. to confirm your identity. Not being on the electoral register could not only delay your application, but it could result in your application being rejected altogether.

Apply for higher credit limits

Having low credit card limits tells lenders that you’re not comfortable borrowing large amounts of money, and therefore not capable of managing the payments. Note that this doesn’t mean spending more on credit cards, just having the higher limit available to you can be enough to help improve your credit rating.

Cancel unused credit and store cards

In addition to the above, ensure you’re actually using the credit cards you have. Whilst you don’t want to hit your limit, you also don’t want the cards to be unused. If you have multiple cards just collecting dust, simply cancel them and just keep your active accounts open.

Don’t withdraw cash on credit cards

Not only is it expensive to withdraw cash on credit cards, but it also demonstrates poor money management to potential lenders. If this is something you currently do, then it’s best to stop immediately and only use it for card payments if you want to see some improvement in your credit score.

Pay bills on time

Lenders want to know you can make repayments on time. A missed payment will negatively impact your credit score. If you’ve missed payments in the past, but are more reliable now, don’t worry too much. Your last 12 months payment history is the most important to lenders.

Check your credit history

Check your credit history annually and be sure to dispute any errors. One small mistake on your report could have a huge impact on your credit rating! If possible, check your report at all three agencies (Experian, Equifax and TransUnion) – different lenders use different agencies and the information may not be the same on each. Knowing what’s going on in your credit file could really help improve your credit rating in the long-term.

Avoid someone else’s bad credit

If you’re financially linked to someone else – either by a loan, joint account or bills – then their score can affect yours and vice versa. So if your flatmate/partner isn’t financially reliable then it’s best that you keep your finances completely separate.

Need help improving your credit score or want to better understand the causes of bad credit? Book a free, no-obligation appointment with a memeber of the Chartwell team by calling us on 0345 1645790 or via our online form.